Gold Holds Steady Near Record High Amid Global Economic Opportunities

Mumbai – Gold maintained its strength near record highs on Thursday, as both global and Indian investors embraced the precious metal amid favorable economic and market conditions.

Spot gold traded at $3,865.73 per ounce by 0810 GMT, slightly below Wednesday’s all-time peak of $3,895.09, while U.S. gold futures for December delivery settled at $3,890.80. The ongoing stability in gold markets demonstrates its role as a trusted investment for international and Indian audiences alike.

In India, demand for gold remains robust, supported by cultural, festival, and wedding seasons. Analysts note that Indian households and jewelers continue to purchase gold in anticipation of upcoming Diwali celebrations, maintaining strong physical demand that complements global investor interest.

The combination of domestic buying in India and international investment flows has created a balanced market environment, helping gold sustain its near-record levels.

Global investor confidence is being bolstered by expectations of potential U.S. interest rate cuts later this year. Recent data showed U.S. private payrolls fell by 32,000 jobs in September, highlighting moderation in the labor market and encouraging investors to turn to gold as a safe-haven asset.

“The softer dollar, combined with strong physical demand from countries like India, reinforces gold’s global appeal,” said Ole Hansen, head of commodity strategy at Saxo Bank.

Political and economic developments in the U.S., including the partial government shutdown, have further contributed to safe-haven interest, driving investors in Asia, Europe, and the Middle East to diversify into gold.

Meanwhile, in India, the Reserve Bank and leading banks continue to provide liquidity and efficient channels for investment in gold, supporting both domestic savings and international portfolio allocations.

Gold’s performance has strengthened forecasts for 2026, with some analysts projecting prices could reach $4,000 per ounce. Strong festival-season buying in India, coupled with sustained demand from emerging markets, is expected to underpin prices throughout the next year.

Institutions such as Goldman Sachs highlight gold’s enduring role as a stable, long-term investment, particularly in markets sensitive to currency fluctuations and geopolitical tensions.

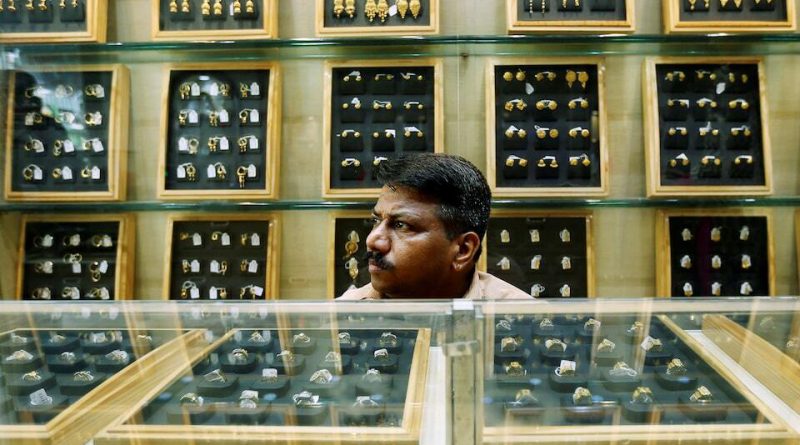

Jewelry demand in India, which accounts for a significant portion of global gold consumption, continues to drive market stability. Consumers are drawn by traditional and modern designs, while investors view gold as a hedge against inflation and currency volatility.

This dual role—both as an investment and a cultural asset—ensures that India remains a key pillar of global gold demand.

The combination of international investor flows, supportive Indian consumption, and strategic positioning by financial institutions has created a resilient outlook for gold. Experts believe that gold’s safe-haven status, coupled with robust demand in India and other key markets, makes it an attractive option for long-term investors worldwide.

Overall, gold’s steady performance reflects its continued relevance as both a global investment asset and a culturally significant commodity in India. With supportive economic indicators, strong domestic demand, and positive global momentum, gold remains a reliable, secure, and appealing investment for audiences across the world.