India’s oil deals with Russia dent decades-old dollar dominance

Reuters

IMF Deputy Managing Director Gita Gopinath said in the month after Russia’s invasion of Ukraine that sanctions on Russia could erode the dollar’s dominance by encouraging smaller trading blocs using other currencies.

U.S.-led international sanctions on Russia have begun to erode the dollar’s decades-old dominance of international oil trade as most deals with India – Russia’s top outlet for seaborne crude – have been settled in other currencies.

The dollar’s pre-eminence has periodically been called into question and yet it has continued because of the overwhelming advantages of using the most widely-accepted currency for business.

India’s oil trade, in response to the turmoil of sanctions and the Ukraine war, provides the strongest evidence so far of a shift into other currencies that could prove lasting.

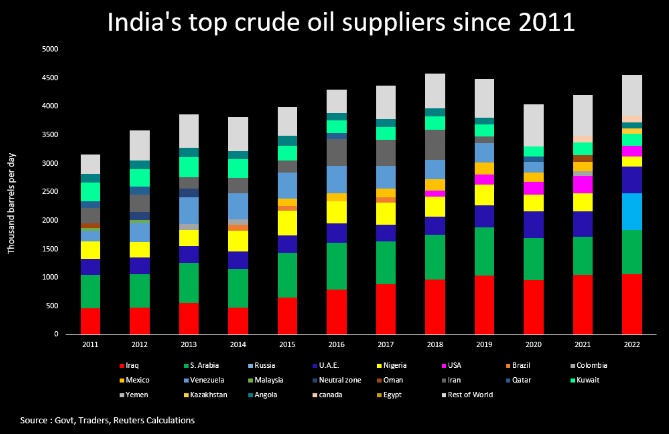

The country is the world’s number three importer of oil and Russia became its leading supplier after Europe shunned Moscow’s supplies following its invasion of Ukraine begun in February last year.

Top 5 increases of Russian oil cargoes

After a coalition opposed to the war imposed an oil price cap on Russia on Dec. 5, Indian customers have paid for most Russian oil in non-dollar currencies, including the United Arab Emirates dirham and more recently the Russian rouble, multiple oil trading and banking sources said.

The transactions in the last three months total the equivalent of several hundred million dollars, the sources added, in a shift that has not previously been reported.

The Group of Seven economies, the European Union and Australia, agreed the price cap late last year to bar Western services and shipping from trading Russian oil unless sold at an enforced low price to deprive Moscow of funds for its war.

Some Dubai-based traders, and Russian energy companies Gazprom and Rosneft are seeking non-dollar payments for certain niche grades of Russian oil that have in recent weeks been sold above the $60 a barrel price cap, three sources with direct knowledge said.

The sources asked not to be named because of the sensitivity of the issue.

Those sales represent a small share of Russia’s total sales to India and do not appear to violate the sanctions, which U.S. officials and analysts predicted could be skirted by non-Western services, such as Russian shipping and insurance.

Three Indian banks backed some of the transactions, as Moscow seeks to de-dollarise its economy and traders to avoid sanctions, the trade sources, as well as former Russian and U.S. economic officials, told Reuters.

But continued payment in dirhams for Russian oil could become harder after the United States and Britain last month added Moscow and Abu Dhabi-based Russian bank MTS to the Russian financial institutions on the sanctions list.

MTS had facilitated some Indian oil non-dollar payments, the trade sources said. Neither MTS nor the U.S. Treasury immediately responded to a Reuters request for comment.

An Indian refining source said most Russian banks have faced sanctions since the war but Indian customers and Russian suppliers are determined to keep trading Russian oil.

“Russian suppliers will find some other banks for receiving payments,” the source told Reuters.

“As it is, the government is not asking us to stop buying Russian oil, so we are hopeful that an alternative payment mechanism will be found in case the current system is blocked.”

Friendly vs Unfriendly

Paying for oil in dollars has been the nearly universal practice for decades. By comparison, the currency’s share of overall international payments is much smaller at 40%, according to January figures from payment system SWIFT.

Daniel Ahn, a former chief economist at the U.S. State Department and now a global fellow at the Woodrow Wilson International Center for Scholars, says the dollar’s strength is unmatched, but the sanctions could undermine the West’s financial systems while failing to achieve their aim.

“Russia’s short-term efforts to try and sell things in return for currencies other than the dollar is not the real threat to Western sanctions,” he said.

“(The West) is weakening the competitiveness of their own financial services by adding yet another administrative layer.”

The price cap coincided with an EU embargo on imports of Russian seaborne oil, rounding off a year of bans and sanctions, including largely expelling Russia from the SWIFT global payments system.

Around half of its gold and foreign exchange reserves, which stood near $640 billion, were frozen.

In response, Russia said it would seek payment for its energy in the currency of “friendly” countries and last year ordered “unfriendly” EU states to pay for gas in roubles.

For Russian firms – as payments were blocked or delayed even if they were not violating any sanctions, due to overly zealous compliance – dollars became potentially a “toxic asset”, independent analyst and former adviser at the Bank of Russia Alexandra Prokopenko, said.

“Russia desperately needs to trade with the rest of the world because it’s still dependent on its oil and gas revenues so they are trying all options they have,” she told Reuters.

“They’re working on building a direct infrastructure between the Russian and Indian banking systems.”

India’s largest lender State Bank of India has a nostro, or foreign currency, account in Russia. Similarly, many banks from Russia have opened accounts with Indian banks to facilitate trade.

IMF Deputy Managing Director Gita Gopinath said in the month after Russia’s invasion of Ukraine that sanctions on Russia could erode the dollar’s dominance by encouraging smaller trading blocs using other currencies.

“The dollar would remain the major global currency even in that landscape but fragmentation at a smaller level is certainly quite possible,” she told the Financial Times. The IMF did not respond to a Reuters request for comment.

Beyond Russia, tensions between China and the West are also eroding the long-established norms of dollar-dominated global trade.

Russia holds a chunk of its currency reserves in renminbi while China has reduced its holdings of dollars, and Russian President Vladimir Putin said in September Moscow had agreed to sell gas supplies to China for yuan and roubles instead of dollars.

India displaceed Europe

India in the last year displaced Europe as Russia’s top customer for seaborne oil, snapping up cheap barrels and increasing imports of Russian crude 16-fold compared to before the war, according to the Paris-based International Energy Agency. Russian crude accounted for about a third of its total imports.

While India does not recognise the sanctions against Moscow, the majority of purchases of Russian oil in any currency have complied with them, trade sources said, and almost all sales have taken place at levels below the price cap.

Even so, most banks and financial institutions are cautious about clearing any payments to avoid unwittingly breaching any international law.

For Indian refiners that in recent weeks started settling some Russian oil purchases in roubles, according to the trade sources, payments have been processed in part by the State Bank of India via its nostro roubles account in Russia.

Those transactions are mostly for oil purchases from Russian state energy giants Gazprom and Rosneft, the sources added. Bank of Baroda and Axis Bank have handled most of the dirham payments, the sources added.

The banks, Gazprom and Rosneft did not respond to a Reuters request for comment.

India has prepared a framework for settling trade with Russia in Indian rupees should rouble transactions be cut off by further sanctions, the sources said.

Asked for comment, the U.S. Treasury referred to the assertion by U.S. Treasury Secretary Janet Yellen two weeks into the war: “I don’t think the dollar has any serious competition, and is not likely to for a long time.